The elimination of the fuel subsidy might cause importers to make less money and choose to sell refined products elsewhere, which would bring about social unrest and bring Nigeria to a complete standstill.

According to Presidency, Nigeria's expensive fuel subsidy program will go on as long as his new administration strikes a balance between priorities despite running out of money. An expensive choice given the administration's financial difficulties brought on by record-low oil prices that are expected to stay that way. Based on average domestic fuel consumption, our independent analysis shows that Nigeria lost $2.9 billion in fuel marketing subsidies last year. This represents a 400% increase from 2007 and 13% of the Federal Budget, which was approved in April 2015. On the other hand, $5 billion is how much the government estimates the subsidy will cost. Interestingly, the Berne Declaration estimated that between 2009 and 2011, at least $6.8 billion in unwarranted subsidies were given out.

What then became of the over $2 billion that the government claims it spent on subsidies but which the fuel marketers never got? All of these topics will be covered in this month's articles.

figuring out the subsidy

The fuel subsidy is determined by subtracting the retail price at the pump, which is currently fixed at N87 ($0.44), from the Expected Open Market Price (EOMP), as stated in the applicable pricing templates. The allowable landing costs, which mainly consist of the cost of the imported product and freight, are added to distributor margins to determine the EOMP. Since landing costs account for about 85% of all allowable costs in the computation, variables influencing landing costs will also have an impact on the amount of subsidy that is ultimately paid.

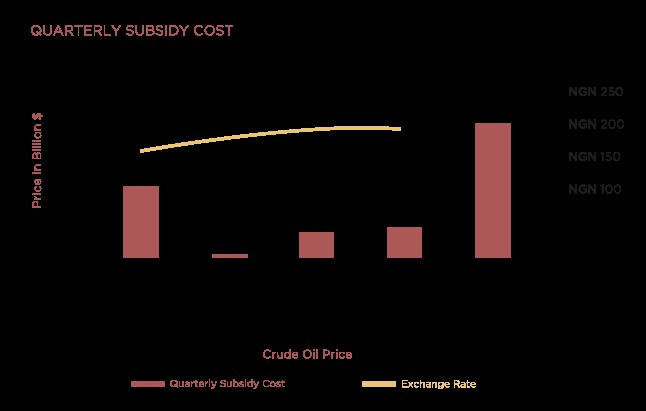

The $:N exchange rate, since the pricing template is denominated in Naira and actual costs of imported goods and freight often reflect changes in underlying crude prices, and global oil prices are the two main drivers of these costs.

An extended (and costly) year

The Nigerian government made huge profits during the comparatively stable period of high oil prices that began in 2011, which helped to maintain the status quo and make it easier to replenish federal reserves after they were depleted. However, as the world quickly entered a decade of low oil prices last year, enormous sums of money were converted and used to finance Nigeria's most recent election—some have called it the most expensive to date—as the two main opposition parties waged a fierce campaign throughout the first quarter of 2015. The severe reliance of Nigeria's economy on oil earnings (the nation essentially needs to import practically everything) made the situation worse: despite its severely reduced revenue, the government had to continue.

First, as oil prices declined, so did the cost of freight and imported goods, which led to a reduction in subsidy payments. In January 2015, marketers could only get N2.94 ($0.02) per litre of subsidy, down from N22.29 ($0.1) per litre in October 2014. Exchange rate fluctuations, however, had an impact on the claim computation, so as the oil price stabilized, the exchange rate started to decline and the subsidy increased once more, reaching N38.76 ($0.19) per litre in April 2015 and N44.86 ($0.23) per litre in July 2015.

Derivative markets anticipate a 15% devaluation, making the short-term stability of the Naira uncertain. This makes devising a strategy to deal with the program's spiraling costs challenging.